We Need To Talk About China

/Ah, China. And Chinese economics... I have been obsessed with China, and in particular its uniquely lunatic economy, for the past few years. Why? Because Chinese economic policy has been the biggest elephant in the global economic livingroom since 1989, lumbering around breaking things while the West says "Elephant? I don't see any elephant. Owch, my foot."

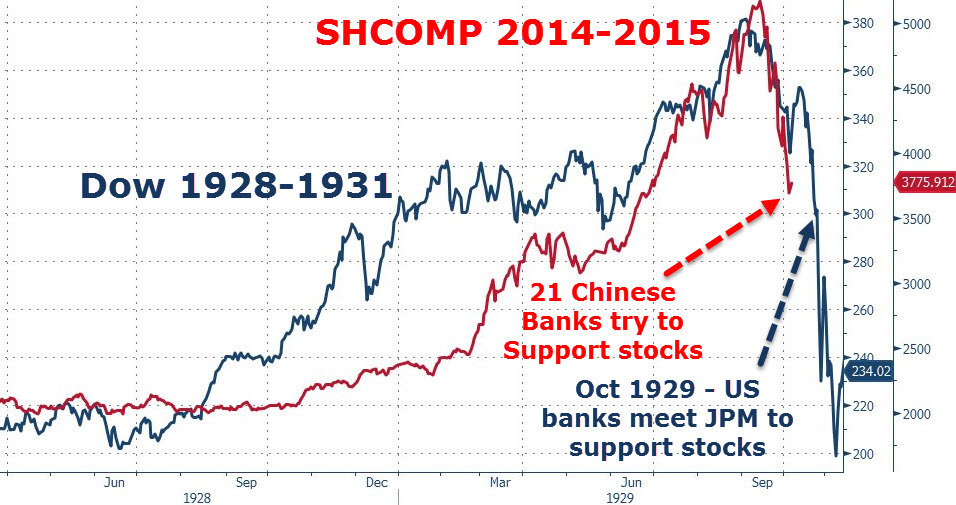

A charming and self-explanatory graph, courtesy of The Daily Reckoning, Australia

A charming and self-explanatory graph, courtesy of The Daily Reckoning, Australia

I’ve come up with, and abandoned, half a dozen plots for satirical stories about the Chinese economy, I’ve written draft after draft of a satirical BBC radio play about the Chinese economy, I’ve read and researched obsessively on the subject. And, every year or so, for the past five years, I have opened up a new file in Scrivener, and started, with furious energy, to write an over-long and over-complicated blog post about China, and how its mysteriously placid economic surface masks a series of catastrophic Communist Party decisions, over the past thirty years, which will lead at some point to China’s implosion, economically and socially… Each time, the post becomes book-length, and I abandon it… Well, here we go again.

Here’s my take on China, boiled down.

In 1989, the Berlin Wall fell; democratic protests swept China; and the Party panicked. They murdered unarmed protesters across the country (including the students in Tiananmen Square), arrested four million people across the country in the following weeks, and then tried to pretend nothing had happened.

Party leaders were determined that China would not collapse like Soviet Russia. So they abandoned Soviet-style economics, and built a gigantic new national financial system, modelled loosely on the Western financial system; but with the state performing every function. As Carl E. Walter and Fraser J. T. Howie put it (in their excellent book Red Capitalism: The Fragile Financial Foundation of China’s Extraordinary Rise), “The state is involved at every stage of the market as the regulator, the policymaker, the investor, the parent company, the listed company, the broker, the bank and the banker.”

And the state decided that 8% economic growth was the target; and the entire economy was configured to hit this target… Well, if you only look at the GDP figures, the Party succeeded. Western free-market economies go up and down like yo-yos, but China has not had a recession since 1976. Even more ridiculous, it's not had so much as a single year of low growth since 1990.

But those reassuring figures mask the roaring balls-up the Communist Party has made of the real economy, particularly in the past decade. Pre-2005, although growth was horribly lop-sided and manipulated, much of it was at least real: the cities that needed connecting were being connected by road and rail; ports and airports were being built in places that needed them; financial reforms were being pushed through; etc, etc.

In 2005, the financial reform program ended, when the leading reformers were ousted (like Zhu Rongji) or died (Vice Premier Huang Ju)– China’s GDP growth figures have been, increasingly, bullshit, driven by terrible lending by the state banks to state industries, massive malinvestment in ever-more-useless infrastructure, and a huge property bubble that has built entire cities and airports in the wrong places.

China’s banks have gone bust once every decade since the seventies, but each time the government managed to recapitalise them, or roll over the bad loans, without writing down the debts. It can’t write them down, because it owes itself the money; to cut the value of the non-performing loans is to say the state can’t pay its debts. It’s trapped. Every bank collapse is a sovereign debt default: and so there can be no bank collapses. But at this point, in my opinion, they’ve finally run out of road. Total debt in China has exploded to unprecedented levels in the past five years.

China, now, is essentially a multi-trillion dollar Lehman Brothers, circa 2007, but with a billion employees. It looks OK, but it is totally hollow; it’s massively leveraged, it’s out of capital, a shit-ton of the assets on its books are in fact worth nothing, and people are starting to believe it’s not good for its promises.

And so China isn’t going to collapse like Soviet Russia; it’s going to collapse like Lehman Brothers.

A giant, weird, slow-motion Lehmans, because it owes the money to itself. So, it will take some time for the collapse to take place. It can print money, roll over debt, do all the things it’s been doing for decades. But, in propping up the fake economy of 8% growth forever, they’ve broken the real economy.

When China finally gets its recession, it's going to be so godawful that it will almost certainly destroy the legitimacy of the Communist Party, which, after 70 years in power, is essentially an incompetent, wildly corrupt, third-generation mafia. Sure, there are some good people in there, but the system itself is totally corrupt, and corrupting, with no mechanism to reform it; and all the alternatives to the Communist Party have been annihilated. Plus, the concentration of power, wealth and influence at the top of the Party has made the leadership of China essentially hereditary, with all the incompetence that entails. (For western examples, think King George III and IV of England, or Presidents George W. Bush I and II, of the former colonies.)

OK, a prediction isn’t a prediction if it isn’t specific. A vague “bad things will happen… somewhere… sometime…” doesn’t count. So here goes.

- The recession will come within the next three years, and will be extremely deep: the Chinese economy will shrink, for the first time in nearly 40 years (and that’ll feel horrendous, from 8% growth to negative growth).

- Many State Owned Enterprises will go bust; the Chinese banking system will collapse; the enormous shadow banking system will collapse; the Chinese stock market will collapse (well, that’s been happening while I wrote and edited this, over the past week or two, so no credit for that prediction).

- How this collapse of the financial system plays out is hard to predict, as it’s all the Chinese state owing itself money, and printing money to pay itself. But that pressure should break the renminbi, which is a joke currency anyway. And pretending to fix the banks won’t work, if nobody believes in them as a safe place to store assets any more.

- In the real world there will be massive unemployment across China (over 15% officially but far more in reality).

- Social unrest will get out of control, with huge street protests and riots in the cities and in the countryside; uncontrolled population movement (something the Party has always feared and tried to control through the hukou residency permit system, which will break down); and anger expressed through violence against anything associated with the Party. (You’ll see a lot of police stations on fire.)

- I believe the Party will lose legitimacy; will lose control of the country; and that, within the next decade, China will break up: Neither Tibet nor the Muslim, Turkic-speaking Uighur territories in Western China can be held without a functioning Party and Army to enforce their occupation.

That’ll do for now.

So why didn't I finish writing and editing all my previous China blog posts, and put them up? Well, the story was so big, and I kept trying to say everything in a single post. But you can't. (And there was always fresh information, new knowledge.) And it was always so much easier to just post a link, or make a sarcastic remark, on Twitter. Sigh. Twitter has ruined my ability to blog. And, five years ago, I felt that if I said "China will collapse", it was probably too soon. I figured China's leadership would be able put it off for another few years.

But now I don't think they can put it off much longer. They will try; but this time I think it's over. I suspect the shadow banking system has already begun to collapse (along with the housing market and the stock market), and with it the Party leadership's control over events.

Anyway, my greatest regret, as a (former) blogger, is in not posting my thoughts about China. (Every few weeks, for about three or four years now, I’ve woken in the night groaning, why didn’t I blog about China six months ago?) So, over the next few months, I'm going to try and put down a few years' worth of thoughts. It's too late for me to get credit for the prediction, but it's not too late to be part of the conversation. And we're going to be talking a lot about China over the next 5 years.